Parametric insurances in the context of climate change and natural disasters

For insurance companies, natural disasters such as extreme floods, droughts or hurricanes have always been difficult to record and model and, so, to insure. Therefore, insurers traditionally restrict their coverage or increase their pricing to protect themselves against the uncertainty of this risk. In this way, businesses often struggle to obtain an adequate coverage for their needs in terms of potential losses occurring because of natural disasters. It is also likely that natural catastrophe losses will continue to grow in the next decades due to climate change and human activities with dramatic financial consequences. To illustrate this point and according to SwissRE, natural disaster losses increase between 5% and 7% per year worldwide and global insured losses were estimated at 105 billion USD in 2021 which was the 4th highest amount since 1970. Moreover, more than half of losses linked with natural disasters were not insured.

As the world continues to face increasingly complex and unpredictable risks, the insurance industry has responded with innovative solutions to help individuals and businesses safeguard their assets and operations. This is why parametric insurances and their use of data come into play as they are bringing more transparency and ease claims management. It is therefore a useful answer to the new challenges that insurance companies face in terms of unpredictable climate damage.

How do parametric insurances work?

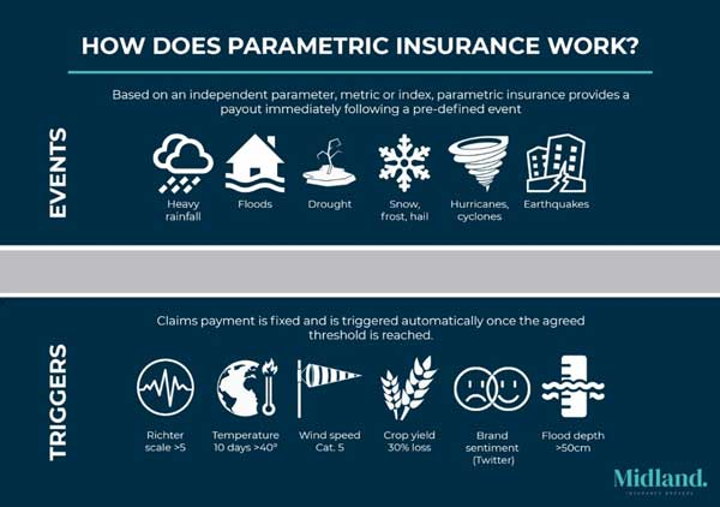

Parametric insurances, also known as index-based insurances, are a type of coverage that pays out a predetermined amount based on a predefined parameter or “trigger event”, rather than assessing actual losses incurred. Unlike traditional insurance, which relies on detailed claims investigation, parametric insurance uses objective and easily measurable indicators, such as weather conditions, seismic activity, commodity prices, or other quantifiable data… More concretely, the insurance engages when a parameter exceeds this predefined quantifiable index, and the claim process is faster as the payout is also defined in advance. Usually, the payout amount is proportional to the value of the index measured up to a predefined ceiling, the “exit threshold”.

For example, in policies against drought risks, the guarantee could cover risks based on a predefined rainfall index. A second example could be this grass growth index used in France to protect farming production, which detects declines in grass production. These indexes can be built, for instance, with satellite or meteorological data. The aim is to give an objective assessment of production or events, with great precision, for an entire territory over a prolonged period. As the earlier non-insurable risks now become insurable, risk managers can then use parametric insurance to complement their traditional indemnity programs.

Fig 1: How does parametric insurance work? [1]

Practically, the contract is tailor-made and includes predefined events to cover such as, for example earthquakes, typhoons, or extremely low agricultural yield. The customer and the insurance company define together the different indexes that will engage the payout if these parameters are reached. Regarding risk calculation and modelling, the insurance considers historical and real-time data like for instance, data about earthquake size, level of rain precipitation, or wind speed measured by weather stations. A third party can be involved to check the parameters and define the extent of the event to ensure transparency and to avoid any conflict of interest. Finally, if the threshold is reached or exceeded, the insured is supposed to directly receive the indemnity payout, full or partial, as it is predefined within the contract as illustrated in the figure below.

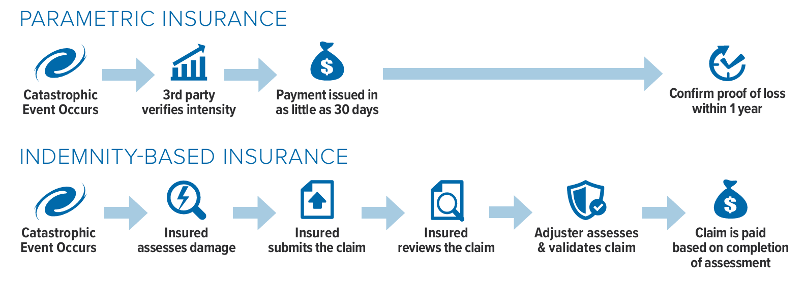

Fig 2: Parametric insurance process [2]

Why are parametric insurances advantageous for policyholders?

1. Faster process

As the payout is automatically triggered when the index exceeds a threshold agreed beforehand, one of the great advantages is that customers know how much they will receive when conditions are met. Additionally, the coverage does not need any added analysis of the causes and consequences of the event because the predefined trigger event figures out when an indemnity payout is due, speeding up the settlement and reducing administrative overheads.

Fig 3: Sequence of events for claims and payout between parametric insurance and a traditional indemnity-based insurance. [3]

2. More transparency

The insurer and the policyholder receive the same information given by the measurement of a meteorological variable, which reduces asymmetry of information. In addition, the simplicity of parametric insurance allows policyholders to clearly understand the terms and conditions of their coverage. Trigger events are objective and verifiable, eliminating disputes and ensuring predictability throughout the claims process.

3. Tailored Coverage

Parametric insurance offers customization options that allow policyholders to align coverage with their specific needs. Industries facing unique risks, such as agriculture, energy, or travel, can tailor parametric policies to address their specific vulnerabilities. This flexibility empowers policyholders to proactively manage risks while optimizing their coverage and reducing exposure to potential losses. Moreover, by relying on objective parameters and data, insurers can offer protection in regions prone to natural disasters or where traditional coverage may be limited.

4. Reduced costs

The payout process is significantly simplified and fast compared to more traditional methods of insurance proceeds that require the use of expertise and various methods of assessing the claim. And, as the claim management process is simplified, it reduces costs, because claims managers, lawyers, or other technical experts will not intervene to assess losses.

What are the limits for using parametric insurances?

The major challenge for this type of insurance obviously relies in data. Accurate and real-time available data are key, as well as specific modelling work in order to identify relevant indices and build them from simple measures. As a result, quality underwriting and fast claims management requires to process huge volume of data with a near real-time analysis. On the other hand, in areas with limited or unreliable data collection infrastructure, parametric insurance may face challenges in accurately assessing and triggering payouts, potentially impacting the effectiveness of coverage.

By nature, parametric insurance is then best suited for risks that can be objectively measured and quantified. It may not be applicable for certain types of risks, such as liability or legal claims, which require individual assessment and evaluation.

Third, the predefined triggers may not perfectly align with the actual losses incurred by the policyholder. This disparity can result in discrepancies between the payout and the financial losses of a specific event, potentially leading to under- or overpayment…

Conclusion and thoughts

Parametric insurance is a transformative approach to risk management, offering simplified and efficient solutions to individuals and businesses across various sectors. While data accuracy can still be challenging in this field, technological advances, and the emergence of insurtech companies make access to quality data easier as well as the ability to develop specific tools for parametric insurance. In other words, insurance companies are becoming able to understand climate risks in an innovative way and start offering coverage for extreme risks that were difficult to insure in the past. As Clydeco suggested in an article, insurers will also have a role to play in helping their insureds implement prevention plans. Thus, thanks to parametric data and insurance tools, insurers can provide means to assess and detect abnormal situations in real time and avoid potential losses, or to limit the consequences by taking preventive measures as soon as possible.

Moreover, the development of parametric insurances can go further than just insuring natural disasters and the resulting agricultural losses. It is also suitable for many other sectors such as agri-food industry, real estate development, tourism or any sector that could be exposed to an event that has an impact regardless of the material damage suffered by the insured. For example, events such as pandemics, disruption of the supply chain, stock indices changes, data breaches, … As this insurance method continues to mature and adapt, its impact across industries and societies is likely to grow, bolstering resilience and enabling individuals and businesses to navigate the challenges of a rapidly changing world.

Sources

Parametric products: incubation to market in a few clicks | swiss re

L’émergence des insurtechs au regard de l’assurance paramétrique : clyde & co (clydeco.com)

Assurances paramétriques – 2021-03 – excès de précipitations (agifra.be)

Assurance paramétrique : les raisons de son succès > early metrics

Résilience aux catastrophes naturelles et assurance paramétrique (aon.com)

Les assureurs regardent vers l’assurance paramétrique, les clients aussi… (journaldunet.com)

Parametric insurance – what is it, how it works and when to use it – midland insurance brokers

10 myths about parametric insurance | swiss re

Parametric insurance solutions | linkedin

How parametric products benefit catastrophe-driven risk transfer (amwins.com)

L’assurance paramétrique : fiable et rapide (axaxl.com)

Figures:

[1] Parametric insurance – what is it, how it works and when to use it – midland insurance brokers

[2] 10 myths about parametric insurance | swiss re

[3] How parametric products benefit catastrophe-driven risk transfer (amwins.com)