Private Equity Funds: A Real Investment Edge

Michaël Bovy

Our world today, since the beginning of the 20th century, has been constantly changing but there’s one evolution that stay consistent since the 2008 Real Estate crisis: the increase of number of Funds and the amount of asset under management in Private Equity Funds.

Interest of investing in Private Equity?

What is a Private Equity Fund?

In simple terms, a Private Equity Fund refers to a pooled investment vehicle that raises capital from institutional and high-net-worth investors to acquire ownership stakes in private companies – or take public companies private – with the goal of improving their social, political and economical way of working in order to sell it in a short to mid period of time for a profit. In other words, a Private Equity Fund collects money from investors, buys companies, improves them, and sells them later – ideally at a much higher price.

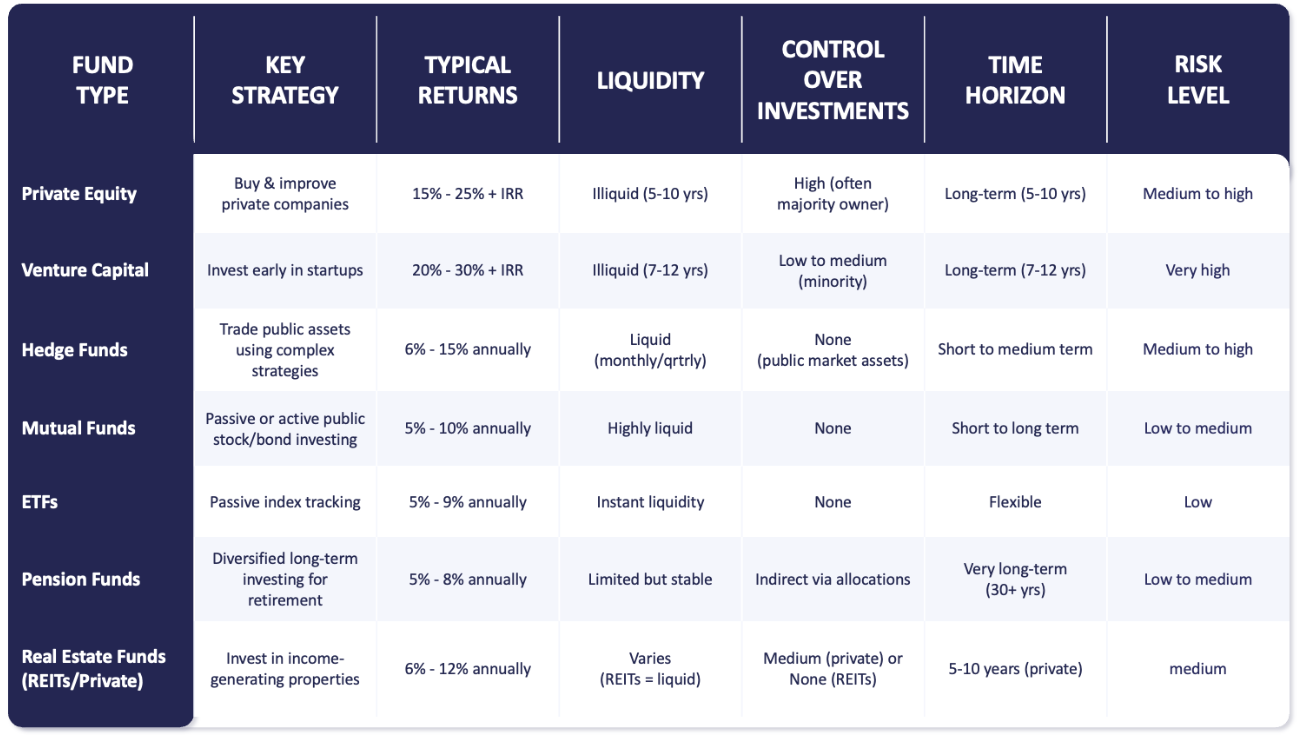

Investors might choose to invest in a Private Equity fund rather than another type of funds (like a hedge funds, mutual funds, standard funds and more) for strategic, financial, and control-based reasons. Investors can be pension funds, investment banks, insurance companies, industrial groups, private equity groups, high net worth individuals, family offices and so on.

In the early years, Private Equity Firms were very often subsidiaries or investment arms of financial and insurance group, the latter’s acting as promoters / initiators, bringing a minimum commitment and raising capital among the financial community around a major investment program.

Today, most of the Private Equity Firms are independent and have developed specific expertise in various types of assets and investment stages.

Some key interests by opening a Private Equity Fund

Private Equity compared to Public Equity

Through private equity investments, you directly influence business and strategy which is attractive to savvy investors seeking specific exposure to a sector, industry or geography. As in fashion, trends and taste change often rapidly, reducing the capacity of the fund to remain relevant and exit on favorable terms. It’s a way for a fund to differentiate itself and define a unique positioning.

On the other hand, by investing in Public Equity you are seeking liquidity, transparency and flexible exposure to the economy. Usually, public players have an array of various specific sector expertise allowing them to cover wider scope of opportunities. It’s a way to hedge, as best as possible their risk by diversifying portfolios.

Higher Potential Returns

Private Equity has long served as a vehicle for delivering superior returns to investors, consistently outperforming public markets especially over long periods. It generates higher potential returns because it gives investors control, uses leverage, and focuses on long-term. The other side of the coin by investing in private equity is that you are often require significant initial fundings, which can magnify gains but also magnify losses. Liquidity risk exists since private equity investors are expected to invest their commitments for several years on average. Despite being higher risk exposure, Private Equity funds have structured deals, strong management teams, and often use debt strategically (leverage) to increase returns.

Longer-Term Investment Horizon

Companies that are candidates for traditional private equity investing tend to have common attributes entered around a change in performance or a repositioning suited for a shorter investment horizon. A long term private equity strategy can be attractive for investors seeking exposure to exceptional and durable businesses. Such businesses have characteristics that minimize volatility from uncontrollable factors. These benefits are further compounded by a longer-term investment horizon, which minimizes friction costs and allows for incremental value capture from secular tailwinds.

The illiquidity in Private Equity

Illiquid investments remove the emotional impulse to sell or switch strategies during volatile times. Investors cannot sell at the first signs of volatility or be tempted to chase returns elsewhere. These assets are truly long term in nature and require patience and discipline to reap the full benefits. This makes sense because fund managers have time to source opportunities and unlock value without the pressure of short-term results. While the illiquidity premium varies, data shows that Private Equity has historically delivered a substantial premium relative to public market equivalents. Investors benefit from locked-in capital, allowing long-term strategies to play out without short-term pressure.

Private Equity Fee Structure

The Private Equity fee structure is designed to compensate fund managers for their expertise and align their interests with those type of investors. It typically consists of two main components: management fees and carried interest.

Management fees are annual charges assessed by general partners (GPs) to cover the fund’s operational expenses. These fees are usually calculated as a percentage of committed capital or invested capital, typically ranging from 1.5% to 2% annually.

Carried interest, often referred to as “carry,” is the performance-based portion of compensation that Private Equity fund managers earn if the fund performs well, typically set at 20% of returns as specified hurdle rate, often around 8-10% unlevered.

Private Equity versus other type of Funds

IRR : Internal Rate Return

So, where is the interest?

Most investors are familiar with traditional investments, which include cash and long-only positions in publicly traded stocks and bonds. Alternative investments are comprised of more complex investments and include private strategies focused on illiquid holdings. Within the private alternatives universe, asset classes include private equity, private credit, real estate and infrastructure. Among these asset classes, private equity is one of the most rapidly growing with assets under management quadrupling over the last two decades.

References

Taleo

Amsterdam

1101 DL Amsterdam Netherlands

Barcelona

08037 Barcelona Spain

Brussels

1050 Bruxelles Ixelles

Belgium

Geneva

1207 Genève Switzerland

Italy

Italy Italy

Luxembourg

L-1611 Luxembourg Luxembourg

Paris

75002 Paris France

Singapore

#06-01 SBF Center

068914 Singapour Singapore