AML/KYC and Compliance are two different but complementary concepts. We will see together the definition and the role of these two professions mainly found in the banking/insurance sector.

Overall definition of the positions

AML/KYC stands for “Anti Money Laundering and terrorist financing / Know Your Customer.”

The person in this role within a company must consolidate customer data through the implementation of internal procedures to collect and analyze documents.

This data must be in line with the regulations in the country where the company is based (bank/insurance).

Following this, the client documentation is forwarded to the Compliance department for approval.

The concept of Compliance was introduced by the Americans (Federal Sentencing Guidelines for Organizations of 1991 (also called “Organizational Guidelines”). See in particular D.E. Murphy, The Federal Sentencing Guidelines for Organizations: A Decade of Promoting Compliance and Ethics, 87 Iowa Law Review 697 (2002)

Compliance is not only limited to banking/insurance but is also conducted in other areas, particularly regarding international corruption and embargo violations. The scope of the jurisdiction of the American authorities has also led a certain number of French and European companies to discover the importance of compliance, often to their detriment, as the cases of Technip, Alcatel-Lucent, Total or BNP Paribas have shown in recent years.

The Compliance department is responsible for ensuring that the company complies with external rules regarding anti-corruption laws. It also ensures that these laws are properly implemented internally so that the company complies with external regulations without violating internal rules.

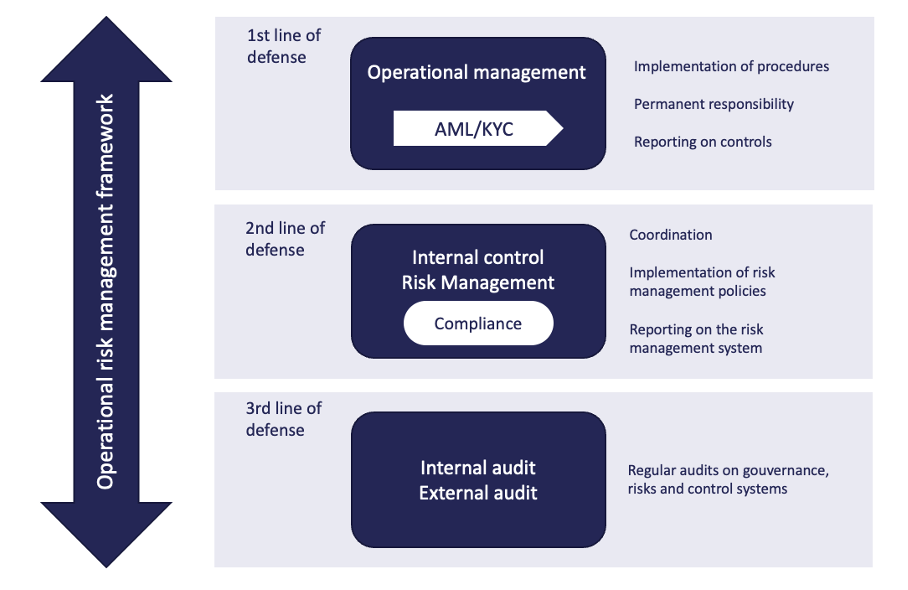

This department oversees drafting and applying procedures for the entire company, including AML/KYC. To make it simple, you will find below a schematic of the main operational lines of defense within a financial company.

In addition, compliance within a company also has the following points to implement and enforce:

- The fight against fraud ;

- The fight against money laundering and the financing of terrorism (LCB-FT);

- The protection of personal data;

- Competition law;

- CSR (Corporate Social Responsibility);

- Safety, health and working conditions.

AML/KYC and Compliance professions are distinct but fundamentally complementary. They serve as important safeguards against illegal activities such as money laundering and terrorist financing while ensuring that companies comply with external regulations and internal policies. By understanding the differences and complementarity of these two professions, businesses can take a more comprehensive approach to risk management, ultimately leading to a more secure and ethical financial environment.