- What are Virtual Accounts?

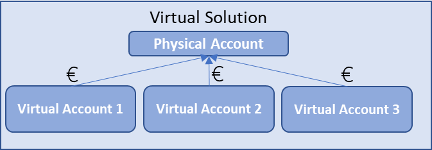

Virtual accounts are different from classical accounts, usually named physical accounts. Virtual Accounts or VA, act as a subdivision of the physical account and are sub-references attached under a dedicated physical account. In some cases, the terminology “virtual reference” is also used. To understand how VA work, it is important to bear in mind that no funds are really on these virtual accounts. Virtual accounts can be considered as an additional layer of the physical account, where customers can initiate and receive payments, allowing them to separate their financial transactions and to improve their ability to monitor their cash flow.

Thanks to VA, corporates can easily allocate different accounts to specific needs without opening different physical accounts for each one and creating additional administrative responsibilities. The main advantage for corporates is to segregate flows per kind of activity, product, service, subsidiary, etc… This will be explained later in this article.

- How does it work?

As mentioned above and given that virtual accounts are sub-references of a physical account, it is crucial to understand how sub-references are used to fully understand how virtual accounts work.

Once a corporate decides to use virtual accounts to optimize its treasury management, the bank usually creates a list of sub-references having the same structure as an IBAN. For instance, the bank generates a file, containing one thousand sub-references and then connects these references to a dedicated physical account. Then, corporates can use these references to initiate payments and to ask to its clients to pay on them.

Finally, the bank establishes a connectivity setup to ensure that the file containing the references is linked to the dedicated physical account. By doing this, all the incoming and outgoing transactions are automatically credited and debited from the physical account.

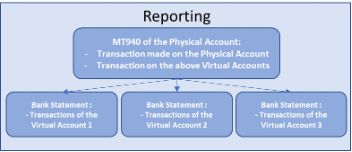

Once the bank creates the end-of-day bank statement (also working with intraday bank statement) for a specific customer and for a dedicated physical account, the reporting file (MT or CAMT) will contain all the transactions that occurred on the sub-references and on the physical account. Finally, based on the information present in the Bank Statement of the physical account, the bank will recognize which transactions are to allocate to which VA and will create a dedicated Bank statement per virtual account.

For setting up and using virtual accounts, the bank can either use its own assets or by using a third-party service provider. The third-party provide offers a software solution that generates bank statements for each virtual account based on the physical account’s statement. Connectivity setup will be required to connect bank’s accounts and reportings to the third-party software offering the solution.

When choosing to use virtual accounts, corporates can access a dedicated session through the e-banking portal of the bank where they can create, delete, rename, and manage VA. The solution is custom-made, and the corporate must customize it depending on its need.

- What are the benefits?

Before explaining the benefits of such a solution bear in mind the elements below:

- Funds are always debited and credited from the physical account.

- Virtual accounts are not accounts, but sub-references of a dedicated physical account.

- You receive a dedicated bank statement for each virtual account, which allows to automatically segregate your reporting based on the information mentioned in the bank statement of the physical accounts

- You can create as many virtual accounts as you want for a dedicated physical account.

- The currency of the virtual account is the same as the one of the physical account.

- Clients and suppliers do not see the difference when paying and being paid.

- Pobo/Cobo (Payment and collection on behalf of): you can ask your subsidiaries to use specific virtual accounts. That way, the treasury directly knows which subsidiaries to allocate the transactions to while the cash remains in the treasury.

You may certainly start to understand what the main advantages of using virtual accounts are but here are some of them:

- Unlimited accounts: you can use and open as many virtual accounts as you want. For instance, you can open an account per kind of product, service, country, subsidiary, supplier, etc..

- Segregation, reconciliation, and pool liquidity: At the end of the day, you can directly be able to see the balance of each VA instead of having all transactions in the same reporting and account. This setup helps to have better cash visibility per kind of activity, client, etc, and then to segregate your flows while centralizing liquidity.

- Decrease administrative burden/KYC: Rationalize bank accounts and bank relationships, which means less paperwork. KYC is only required for the Physical account holder but is not to be performed for each virtual account.

- Use cases :

- Mono entity: We refer to a mono entity when a client only uses its virtual accounts for its own core entity and not for its subsidiaries.

Example: Tango, is a chain store selling clothes that owns 50 shops across France. At the end of each day, the treasurer would like to know how each shop has performed. The first solution would be to ask all the shops to use the same account but will lose the cash visibility per shop. Another solution would be to open one account per shop, but this would be costly and would require a lot of administrative tasks. Instead, the treasurer can decide to use Virtual Accounts and allocate one VA to each shop. By processing that way, the treasurer can directly see the performance of each shop while having all the cash in the same account.

- Multi-entity setup: We refer to multi-entity setup when a company decides to use and distribute virtual accounts to its subsidiaries.

Example: Elon is a car manufacturer that owns subsidiaries all over the world to produce the different models and parts of its cars. Each of its subsidiaries owns an account in the local currency but needs accounts in other major currencies (ex: euro, dollars, etc…) to pay suppliers. In order to avoid opening accounts in Euros for each subsidiary, the treasurer can decide to use a VA solution and distribute the reference to its subsidiaries. This solution can then be applied to other currencies and reduce costs and administrative burden.