The LIBOR Reform’s Impact on Derivative Trading

Alexander Lee

In 2014, the Financial Stability Board released a report (FSB) for LIBOR and equivalent rate reforms. By 2021, these reforms led to the discontinuation of the CHF, JPY, and GBP LIBOR and the replacement of the USD and EUR LIBOR, causing a significant change in the trading volume of interest rate derivatives. Markets moved away from LIBOR-based products, increasingly adopting derivatives of ‘nearly risk-free’ rates (RFR) (Taleo news article).

This article delves into the critical role of IR derivatives in safeguarding the value of banks’ loan portfolios against interest rate movements. It further explores the LIBOR reform, detailing the transition’s necessity and objectives. Lastly, we examine the reform’s impact on the trading volumes of interest rate derivatives, highlighting the emergence of basis swaps that utilize multiple reference rates.

1. Why was the LIBOR reformed?

Banks handle a large portfolio of loans from corporate and consumer clients. Consequently, they must frequently borrow due to minimal excess capital requirements, facing significant interest rate risks. Interest rate swaps, the most prevalent derivatives, mitigate this risk by fixing borrowing or lending rates through agreed-upon periodic payments. These derivatives are primarily used for hedging against interest rate movements, as highlighted by the similarity in size between banks’ loans and derivative portfolios.

The challenge arises from the need for a standard reference rate in derivative contracts. Historically, the LIBOR and its equivalents have been determined through bank surveys, reflecting the cost of unsecured interbank funding (Investopedia – LIBOR).

However, due to vulnerabilities like rate manipulation, reforms have shifted towards transaction-based, ‘nearly risk-free’ rates (RFRs), moving away from survey-based benchmarks like LIBOR. This change, driven by manipulation scandals and the resulting reforms initiated by the Financial Stability Board report in 2014 (FSB article), led to the discontinuation of the CHF, JPY, and GBP LIBOR in 2021, with the replacement of LIBOR equivalent rates across other currencies on different dates (bis article).

2. Comparing the loan and derivatives portfolios of banks

According to the financial statements of BNP Paribas and ABN AMRO, loans, mainly from residential mortgages and corporate/customer loans, account for over 65% of their assets. Liabilities are predominantly deposits from banks, credit institutions, and customers, comprising more than 76% of their total liabilities. Table 1 highlights the significant presence of IR derivatives for hedging, closely matching the volume of loans and deposits, emphasizing their role in loan provision and risk management.

| Bank | BNP Paribas | ABN AMRO |

| Loans | 230.563 | 246.910 |

| Total assets | 350.392 | 379.581 |

| Deposits, banks/credit institutions | 46.295 | 17.509 |

| Deposits, customers | 212.692 | 255.015 |

| Total liabilities | 319.341 | 356.767 |

| IR derivatives (hedging) | 192.799 | 193.321 |

| Total derivatives (hedging) | 210.267 | 208.976 |

The alignment between IR derivatives and loans/deposits points to hedging’s importance, though discrepancies exist due to the classification of other instruments as loans and the use of IR derivatives for purposes other than hedging, like market-making. Specifically, ABN AMRO’s trading book shows a much larger IR derivatives portfolio than its hedging portfolio, indicating a diverse approach to using these financial tools.

3. The IR derivatives market

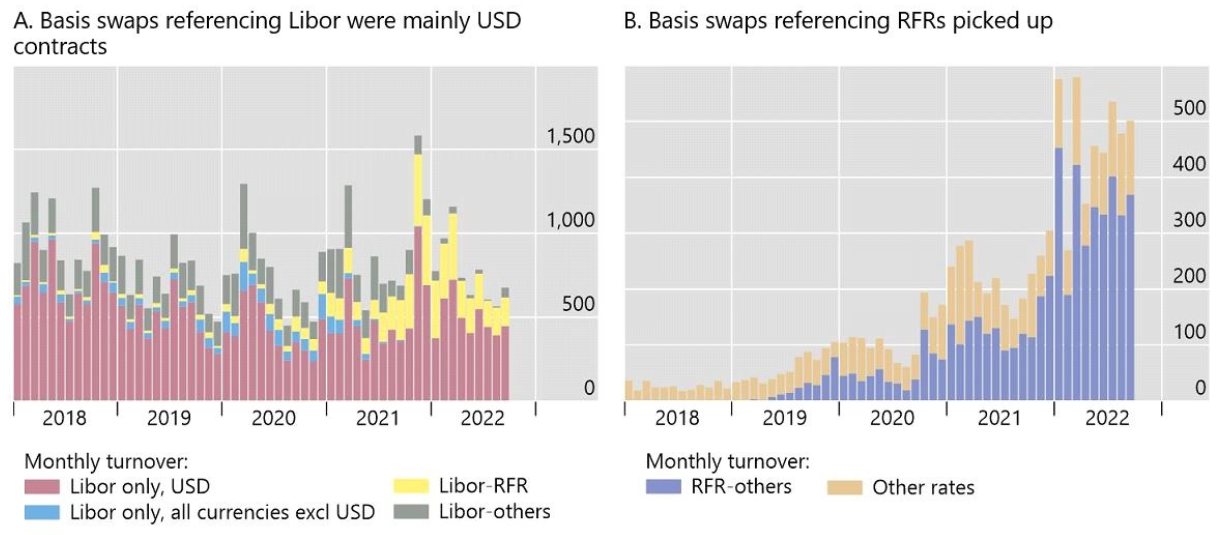

More recently, when comparing the trading volume of LIBOR-based and alternative interest derivatives, Figure 1 shows a trading volume shift between 2018 and 2022.

Figure 1: In Billions of USD, the monthly trading volume of LIBOR and alternative RFR-based interest rate derivatives between 2018 and 2022. Source: https://www.bis.org/publ/qtrpdf/r_qt2212e.htm

Figure 1: In Billions of USD, the monthly trading volume of LIBOR and alternative RFR-based interest rate derivatives between 2018 and 2022. Source: https://www.bis.org/publ/qtrpdf/r_qt2212e.htm

LIBOR-only interest rate swaps trade the LIBOR fixing at the start of the corresponding loan period for a pre-fixed payment. LIBOR-other or RFR-other swaps trade one reference rate for another and are called ‘basis swaps.’ In major currencies apart from the USD, the LIBOR ceased trading at the end of 2021 with replacement provisions for outstanding contracts, as shown in Figure 1A. At the same time, the trading volume of basis swaps has increased substantially, as shown in Figure 1B.

4. Conclusion

Banks use interest rate (IR) derivatives to hedge against their loan portfolios’ and market-making activities’ interest rate exposures. LIBOR and equivalent rates have historically met the need for a formal reference rate in IR derivative contracts. However, due to manipulations and the subsequent call for reform by the FSB in 2014, there has been a shift towards using ‘nearly risk-free’ reference rates (RFRs) and away from LIBOR/IBOR-based derivatives, with the discontinuation or replacement of the LIBOR by the end of 2021 across the five major currencies. This transition has altered trading volumes and fostered a market for basis swaps, accommodating the diverse reference rates banks now utilize in their IR derivative holdings.

References

https://www.fsb.org/2014/07/r_140722/

https://www.investopedia.com/terms/l/libor.asp

https://www.bis.org/publ/qtrpdf/r_qt2212e.htm

BNP Paribas 2022 annual report

Glossary:

BIS: Bank for International Settlements (news and statistics about the derivatives market)

LIBOR: London Interbank Offered Rate

RFR: ‘nearly risk-free’ rates, consistent with bis article

FSB: Financial Stability Board

JPY: Japanese Yen

USD: United States Dollar

EUR: Euro

CHF: Swiss Franc

GBP: British Pound

Taleo

Amsterdam

1101 DL Amsterdam Netherlands

Barcelona

08037 Barcelona Spain

Brussels

1050 Bruxelles Ixelles

Belgium

Geneva

1207 Genève Switzerland

Luxembourg

L-1611 Luxembourg Luxembourg

Paris

75002 Paris France

Singapore

#06-01 SBF Center

068914 Singapour Singapore